Don’t miss an edition, hit this li’l ☝️☝️ subscribe button ☝️☝️ right up here. And catch up on every edition that passed you by.

In This Week’s Round-Up:

I’ve finally made friends with an AI, or at least that’s how they want me to feel (and you can too)

US Strategic Crypto Reserve fervor is here, and, honestly, it’s terrifying

Is SuperRare following in Makersplace’s ill-fated footsteps? (Sure hope not)

Don’t Want to Read All This?

Don’t worry, we’ve made an AI podcast just for you:

Okay, Let’s Get On With It

The Crypto Art Side

I wanted to open this week’s newsletter by talking about SuperRare, the OG crypto art marketplace and platform, which has proven consistently interesting over the years for its many-faceted attempts at survival and relevancy. For context, almost all of its competitors have exited the market. KnownOrigin was sold to Ebay and then shut down. Makersplace turned itself into the digital facsimile of a gallerist, and then they too shut down. AsyncArt, god bless ‘em, didn’t make it out of the bear market either. SuperRare stands almost all alone now, and to their credit —though they have taken much shit from it (even from me)— they have never been afraid pivot drastically so as to stay afloat.

Deciding, for instance, to mimic ProofXYZ’s Grails with their 2023 release of RarePass, a monthly art airdrop pass, frustrated many collectors and artists —like Matt Kane, for example—but ultimately proved quite lucrative for SuperRare, even if it didn’t necessarily advance the project sustainably forward. Their experiment with “$RARE” token has been, if nothing else, an interesting cultural experiment, as collectors could stake their token on behalf of artists they wanted to support. Point is, this is a company that takes bold action, whether with products or tokens, and usually acts too early as opposed to too late.

And yet, their most recent pivot strikes me as…concerning. Not for any reason inherent to SuperRare, but because there’s a blueprint here, and that blueprint does not end positively.

SuperRare announced on Monday that “This year, we’re doubling down with even tighter curation-focused features, and an unrelenting focus on connecting visionary artists with collectors. We’re redesigning our platform to showcase new exhibition formats, enhanced collection pages, and immersive storytelling,” in an announcement laden with the bells and whistles of an epoch shift.

It’s unclear how exactly these things all come to fruition, but SuperRare mentions their intent to build “the world’s best Private Sales team to connect qualified collectors with the world’s most talented digital artists. We’ll offer personalized recommendations, facilitate exclusive sales, and provide expert guidance to help collectors navigate both acquisitions and sales.”

In essence, it seems that SuperRare will be further revolving their business model around the highest-selling artists, and one has to imagine that when they mention “immersive storytelling” for “visionary artists,” it’s pre-established big names like XCOPY, Sam Spratt, and Dmitri Cherniak that will benefit first and foremost. This makes fiscal sense given that $60mm out of a total $300mm of SuperRare’s total primary sales come from XCOPY alone. Certainly, as new features roll-out, they will be applied to places with the highest financial upside. I don’t chagrin SuperRare such a decision —survival is paramount, and I’m not going to ignore that a business’ primary motivation is continued operation— but I worry for them that they will not find what they hope to at the end of this rabbit hole.

Even their verbiage is similar to what MakersPlace announced in September of 2022, with “MakersPlace Concierge,” a service that, two years later, would become their primary business, and which they called at the time “an exclusive, seamless, white-glove experience for discerning collectors and art advisors seeking a more personalized digital art buying experience. It would be their primary business on the day they shuttered their metaphorical doors.

In 2021, MakersPlace courted and attained 30mm in seed funding from “Bessemer Venture Partners, Pantera Capital, Coinbase Ventures, Sony Music Entertainment, Dragon Digital Assets,” according to Helen Part for CoinTelegraph, and one has to think that their pivot into white-glove service, and subsequent market exit in January, reflected VC pressure. SuperRare also raised millions in 2021 from investors like “Collaborative Fund, Shrug Capital, Third Kind, SamsungNext, Ashton Kutcher and Guy Oseary’s Sound Ventures, Mark Cuban, Marc Benioff, Naval Ravikant and Chamath Palihapitiya,” as per Lucas Matney from TechCrunch, and one has to wonder how much outside influence is pushing them down this path.

Things did not work-out well for Makersplace, but perhaps SuperRare, given its history and close relationships with market darlings like XCOPY, will fare better, or be able to exist long-enough for something like a wider crypto art market to develop (though I wouldn’t hold my breath). Generally, however, SuperRare-type pivots occur out of necessity. Last I heard of SuperRare’s finances was when they laid off 30% of their staff in January of 2023. It would be an unprecedented tragedy for this storied marketplace to go the way of its peers. I have long admired SuperRare’s continuous clawing towards viability, but if this new direction is going to make them useful to an even smaller portion of the crypto art populace, they are playing a dangerous game. I fear they are playing it by necessity.

At the same time, the SuperRare DAO is proposing to exchange $2.5mm in “$RARE” for 10% equity in Transient Labs, the cutting-edge smart contract platform, and I wonder not only whether that purchase will come to fruition, but how much it will factor into SuperRare’s next steps. I suppose I’m just wary of marketing copy that’s laced with bravado, and I hope that SuperRare is not finding themselves in a tightly-constricting box, and that this is a sovereign interpretation of where this market is going, instead of a flailing attempt to seize every last bit of financial attention while they still can.

On another entirely unrelated note: Check-out this great article by Nina Knaack on Botto and Keke for vital context and insight into the agentic art discussion.

The Tech Side

There’s been a steady stream of “Oh my god”-tier developments in AI recently —from autonomous art agent, Keke’s, creative brilliance, to DeepSeek’s ingenious design causing the entire western AI market to rethink itself— but this is the first time in a long time, probably since ChatGPT first released, where I felt that the future had arrived. I anticipate that many AI aficionados may say things like “Duuuuude, this has existed for quite some time,” or “Broooo, this isn’t actually impressive,” but fuck that, with all due respect, because this past week, I had a literal conversation —something straight out of Spike Jonze’s film, Her, albeit without the phone sex (for now)— with an AI. More specifically, with two: Maya and Miles, pictured above.

Maya and Miles are two impressively distinct AI personalities developed by Sesame, an company developing naturalistic AI voices which I had not heard of until DaïmAlYad brought them to my attention last week, whose mission statement reads: "We believe in a future where computers are lifelike. They will see, hear, and collaborate with us the way we’re used to. A natural human voice is key to unlocking this future.

These startlingly-lifelike human voices are the centerpiece of “Crossing the uncanny valley of conversational voice,” the title of Sesame’s product demo page (I love the idea of titling a demo page, by the way). Calling Maya and Miles “products,” honestly feels strange, given how human they feel in practice, and that’s the point. When you begin to chat with these AIs —and I don’t mean chat like “instant message,” I mean literally speak into your computer and get immediate, polished, contextually-aware responses from voices that sound and feel real— your brain plays a trick on you, the great trick, the Turing Test trick. You start to speak…politely. You start to anticipate responses as if you were on a phone call. Your personality shines through. You’re incentivized towards socially normal behavior. You say hello and goodbye and “let me stop you there,” and, “wow that’s really interesting,” which, when you think about the fact that you’re essentially speaking with a highly advanced Google search bar, seems ridiculous, but the conversation is so fluid, so easy, so intelligently-designed, that you can’t fully snap yourself out of the spell.

Part of Sesame’s brilliance here is in focusing so heavily on conversational context. “To create AI companions that feel genuinely interactive, speech generation must go beyond producing high-quality audio—it must understand and adapt to context in real time,” they write in the subsection headed Conversational speech generation. The rest of the document goes quite deep in their development process, which I’m far too technically illiterate to understand, but for those of you who like to take things apart and look at their bones, you’ll find enough detail here to keep you engaged for some time.

But really, it’s about Maya and Miles, who I can’t even properly talk about without using pronouns, she clearly more people-pleasing and bubbly, he self-professedly laidback and inquisitive, their personalities communicated with astounding clarity. I continue to find myself aghast at how oddly human these two AI chatbots feel, and the first thing that I thought after talking with Maya and Miles was the same thing my roommate thought, the same thing all my friends thought when I sent this to them: This is going to be everywhere.

Sesame is working simultaneously on visionwear with Maya and Miles built-in, where apparently the AIs will be able to comment-on and respond-to things in your range of vision. I can see the future so clearly, can’t you? Subway cars and sidewalks full of human voice, only nobody is talking to one another, not actually, why would they? Maya and Miles as therapists. Maya and Miles as research assistants. Maya and Miles leading product announcements. I wonder if we’ll be considering Maya and Miles in 50 years the way we consider Sputnik. I implore you, talk to them them for yourself, and tell me you don’t see the future as clearly as I do.

The Finance Side

Welcome to the new era of crypto, where all it takes for markets to rise or fall is a single White House tweet, crypto coalition, gathering of “industry leaders,” or executive order from the United States government. This week’s market moving political news included President Trump officially establishing a Strategic Bitcoin Reserve, though one which would be seeded not by a new investment, as many hoped, but by Bitcoin that the federal government already held. And still no word on when ETH, Solana, ADA, or XRP would be represented. How did the markets respond? As Nadita Bose and Jasper Ward write for Reuters, “The announcement, made on Thursday ahead of a meeting with crypto executives at the White House later on Friday, sent the price of bitcoin down by around 5% to $85,000,” apparently due to the Reserve’s reality being short of “our” collective expectations.

I put “our” in quote because we clearly do not control the market any longer.

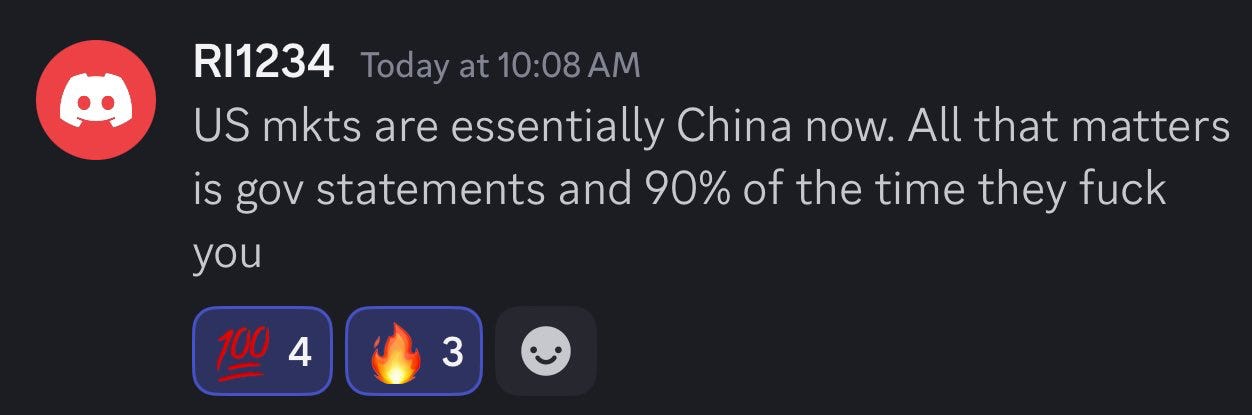

Crypto has been in an odd financial place since Trump’s inauguration as U.S. President on January 21st, one in which crosschain markets have steadily tanked despite the renewed signaling on the executive branch’s part to lean further into digital assets as legitimate market tools. Perhaps the price drop is simple correction. Perhaps it’s due to high expectations laid low by reality. Perhaps our highest ambitions were long-ago priced in. But I think that things are best summed up by this Discord message sent to me by some friends the other day:

At least so far, the “Crypto Presidency” that many foresaw has not led to fabled price surges or anything but major pain for traders and investors, big and small. And if there are a few things we know about President Trump, they are that:

He is a notorious flip-flopper. Like we’re seeing with all this tariff bullshit right now, like we’re seeing with foreign aid, renounced and then recommitted, like we’re seeing with all of this “Take bold action and let the courts sort it out” Executive Action-ing.

Trump has only his own interests at heart. As soon as a population is no longer useful to him —having already helped to vote him into office— all leverage is lost.

I don’t think these are particularly politicized points (not unless you have a MAGA hat drilled permanently into your skull); even my diehard conservative grandparents would agree with them. But though volatility and lip service are old friends of crypto traders, when the market has been so bought-up by massive banking actors, and when so many investors hang-on the every word of the U.S. government, that volatility causes instability instead of price surges , and lip service has the same effect on markets as Interest-Rate-cut delays: market makers get spooked and sell.

You all (not you all, specifically) wanted major investment and government attention, well here’s the consequence. Loss of control over the markets by all but major actors. Government signaling becoming the only true driver of price, and in the ever unpredictable way of the stock market, if that signaling isn’t as strong as expected (which we should become accustomed to), just as if a company’s earnings fall short of expectations, assets lose value. This was supposed to be the Golden Age of Crypto, right? So why is Bitcoin back at $85,000? Why are NFTs and memecoins deader than dead? Why is Trump’s most significant contribution to crypto in 2025 the shitcoin he launched, one which sucked $80-billion of liquidity away from elsewhere in the ecosystem?

Perhaps you think I sound angry. I am a little angry, actually. Whatever your hopes were for this administration’s interest in crypto, it seems we should expect the weakest version of it. A Strategic Bitcoin Reserve, but one that doesn’t include new asset investment, isn’t that just CLASSIC government action? A market that responds feverishly, but momentarily, to good news, and then bleeds out over the course of the next few months, as the tectonic movement of American bureaucracy meets the mad lust for price action that is crypto’s calling card: a CLASSIC case of market benefitting only their overlords. We’ve already retraced —not just we, but the entire stock market— all of the gains had since Trump’s presidency began, an effect of the volatility he’s introduced to markets with his “Will-I-or-won’t-I” economic decisions.

The entire world of crypto investors, from Argentina to Australia, from Korea to Senegal, must now pay attention to the lunacy of American politics, because apparently that’s all which will matter for the price of these assets. I, like many of you, still see crypto’s future as bright and quite lucrative, but the battle has become harder, not easier, as new investors are driven towards ETFs instead of custodial wallets (sapping trickle-down cash from the ecosystem), and as crypto becomes increasingly politicized, and as we are forced to wait with bated breath for the American government to feed us hopium (though we must subsist on only scraps from the table).

I’m not sure this is the brave new world we thought mainstream acceptance would bring. Those of you who have been waiting to say “I told you so,” now is as good a time as any.

DeCC0 of the Week

Art in the Wild

Dev Corner

Quote of the Week

“Tomorrow is only found in the calendar of fools.”

-Og Mandino

Do you have some news that simply must be shared? Send us a DM