Please enjoy today’s DEAR MOCA column. Have questions you’d like answered? Have a thought you want us to respond to? Email us at hello@museumofcryptoart.com or submit your questions to our dedicated Google Form.

Dear M○C△,

All right Solana boy, you talk all the time on your podcast how you got your start in NFTs as a Solana Maxi, so why don’t you tell us what the hell is going on with Solana right now. WHY DO PEOPLE CARE SO MUCH ABOUT SOLANA SUDDENLY I DON’T UNDERSTAND

Sincerely,

Salty About Solana

Dear Salty About Solana,

All right! Finally! Last column of the year, getting to talk about Solana! What a joy! And also, just want to say I love the energy, really get a sense of the vibe here, let’s see if I can do it justice.

So I’m actually going to take you back in time a bit to the magical days of August 2021. See young, freshly-vaccinated Max worry-less on his parents’ porch, beautiful summer evening, crickets and cicadas at dusk, last of the day’s honeysuckle scent waltzing on the breeze, that songbird style of New Jersey night you wish so desperately to communicate to all the Garden State detractors who flippantly call your native land something like the Asshole of America or the Worst Smelling State in America, and all because they drove down the turnpike once, but they’re missing out, they don’t know about nights like this.

Anyways, I’m getting away from myself.

At this point, I had been investing in Solana for about 6 months, on the very emphatic recommendation of my good friend Jake (who you can hear me speak with on MOCA LIVE a few months ago). I’d held a small amount of Ethereum and Bitcoin since 2017, so I knew a little about cryptocurrency itself. And I’d lost a frankly intimidating amount of money when NBA Topshot imploded, so I know a bit about NFTs too. So this same good friend, he calls me in a frenzy, he’s talking a mile-a-minute about something called “a mint,” for an NFT project called “Degenerate Ape Academy,” which was using a technology called “Candy Machine” to spit out randomly-generated, 3D monkey picture assets in exchange for liquid Solana.

O, how many of my lives began that day: I downloaded my first crypto wallet, Phantom. I navigated the nerve-wracking process of sending crypto from Coinbase to a custodial wallet. I slammed a mint button as often and as quickly as humanly possible, because as my buddy told me, these things were going to skyrocket in price, and I saw —really for the first time in my life— riches in my future.

I spent the rest of that bull cycle minting and flipping and trading as many Solana PFP projects as I could, eventually joining MOCA, learning more about Ethereum, falling in love with crypto art, following every trendy mint, airdrop, and memecoin on Solana all the while.

Here are some of my first mints:

The Degenerate Ape Academy was one of the first projects to mint on Solana, and so I watched firsthand as the NFT scene there emerged, exploded into prominence, and then faded away to near nothingness during the bear market. I’ve basically been there for it all. At MOCA, I was always “the Solana guy,” which more or less meant it was my duty to defend my native chain from all who maligned it (more-or-less accurately) as a VC-funded, ultra centralized, artless wasteland of shitcoins and mindless PFP. But it was my wasteland of shitcoins and mindless PFP!

All of which is to say, I’ve loved Solana since my first days, and I suspect I will love it until my last.

Which has made it extremely strange to watch the broader crypto landscape —including a host of artists I know from Ethereum, folks who have previously dabbled in Solana like Cath Simard, Patrick Amadon, and OakArrow— begin to exalt the chain. The cross-over seems to be happening en masse; the many Solana-project Discords I’m in talk frequently about all the Ethereum money entering the Solana ecosystem. The “if you can’t beat ‘em, join ‘em” phase has seemingly begun.

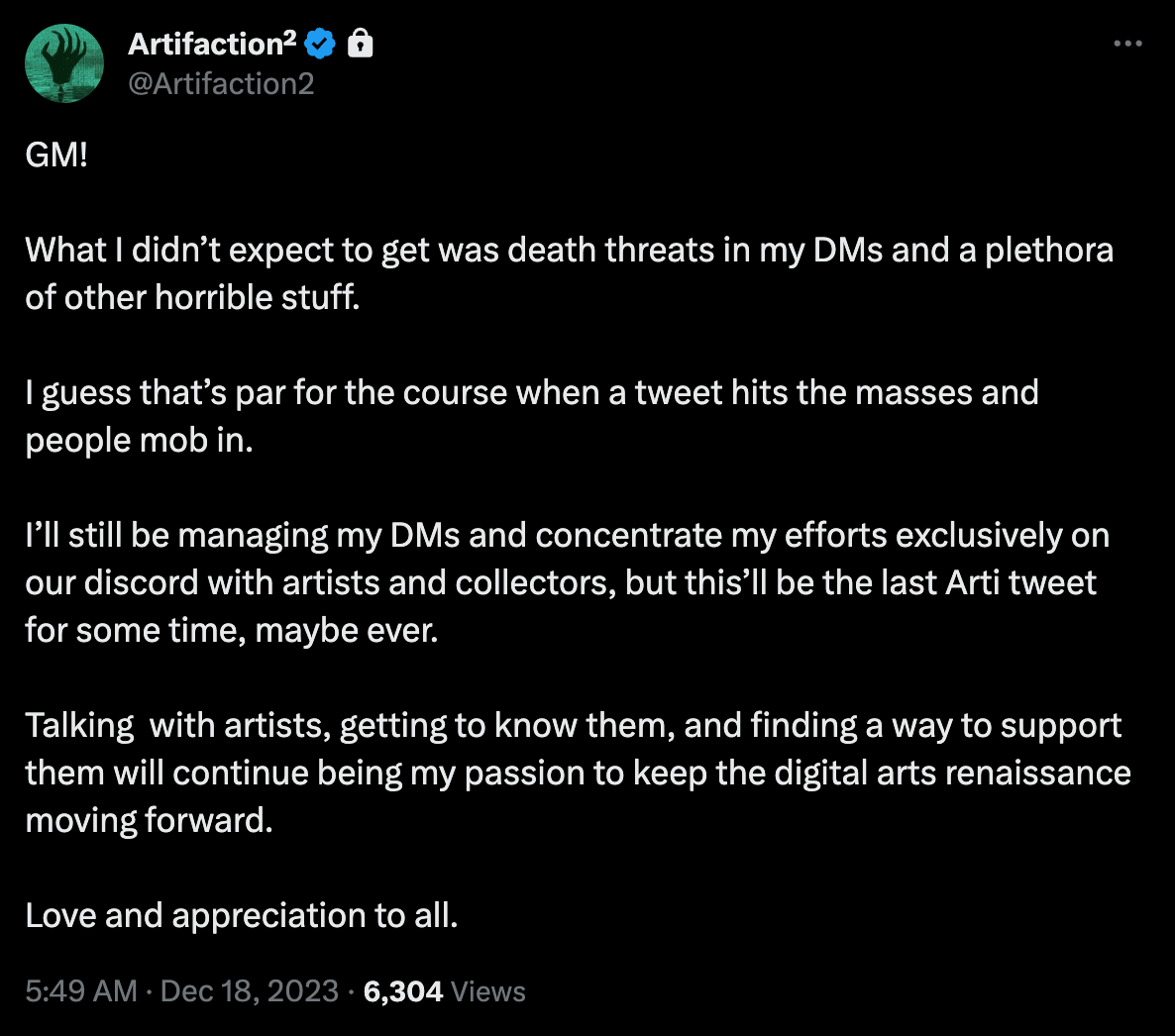

But not everyone is thrilled about that. Artifaction2, founder of Noble Gallery, recently tweeted about their belief in Solana’s dominance going forward, and the online reaction was so irrationally enraged that Artifaction announced an indefinite leave of absence from Twitter. But that, I suppose, is what happens when a groundswell of enthusiasm and activity emerges from seeming nowhere, leaving many unaware, threatened, confused.

So why now? Why, after being considered the shit on Ethereum’s bootheel for so long, is Solana rising to prominence today? Why are notable figures from the development, influencer, and artist sides all announcing their at-least partial defection to Solana? In your own words Salty About Solana: “WHY DO PEOPLE CARE SO MUCH ABOUT SOLANA SUDDENLY I DON’T UNDERSTAND.”

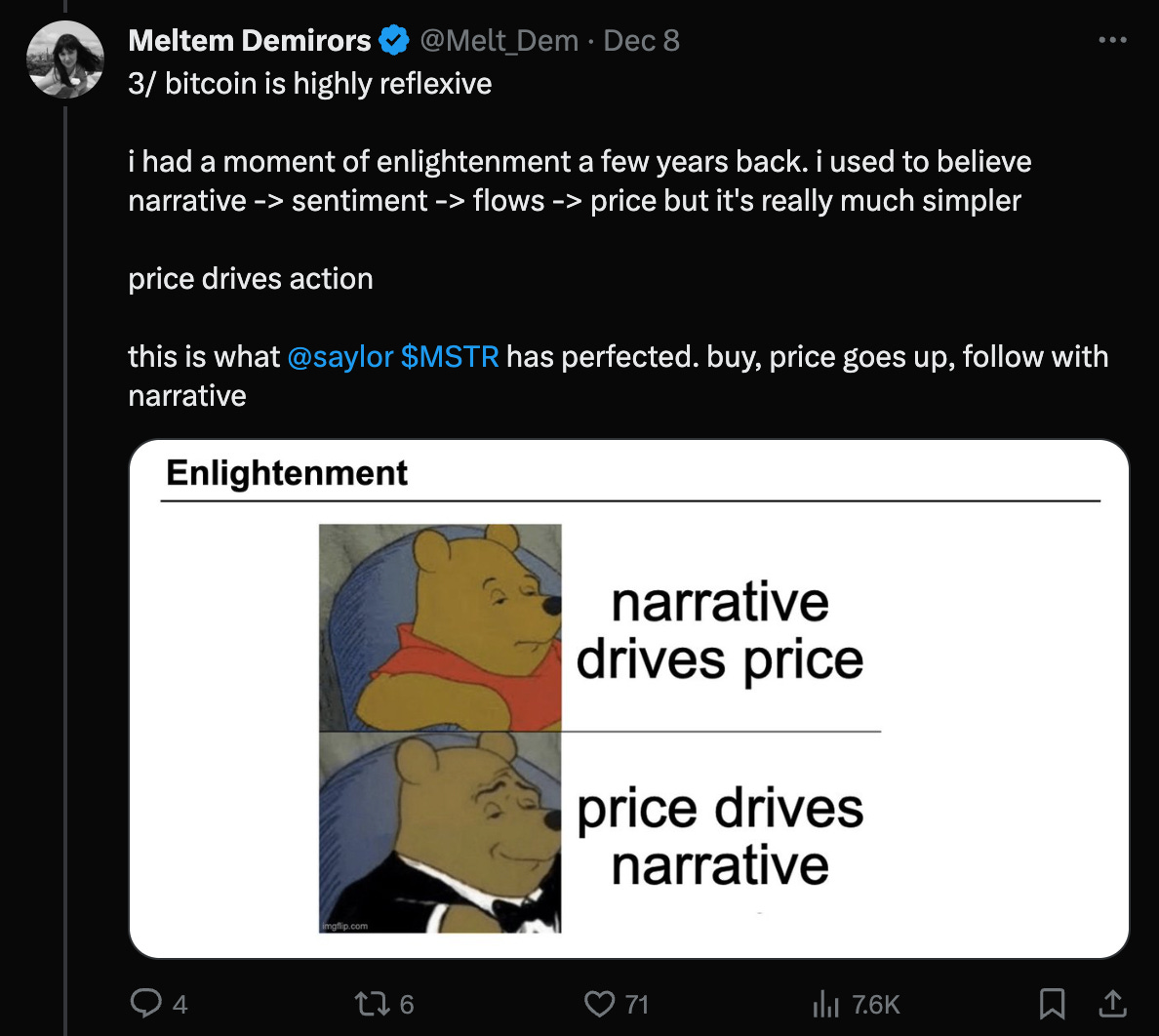

Colborn recently invoked a Meltem Demirors thread where she discusses how it’s not narrative which drives price but price which drives narrative. And perhaps the most notable difference between Solana today and Solana six months ago is that it has seen a price increase proportionally greater than any of the other big chains, rising 550% from ~$15/coin to its price today at around $81.

So the narrative of Solana’s competitiveness gets built into the price. But what people are finding when they move over to Solana —and this isn’t an advertisement I swear— is a really sleek, quick, and cheap ecosystem with a staggering amount of intuitive trading tools. Solana has always tended towards an “efficiency is king” mindset, which has trickled down into the culture itself. Apps and mints and trades generally run well on Solana, waiting times are little, and gas fees are negligible. Compare this to Ethereum, where gas fees regularly spike to exclusionary levels, where apps are routinely being hacked or otherwise proving unsafe, where shitcoining is basically impossible (because of transaction fees), where DeFi tools run more slowly, are more expensive, and are overall clunkier.

Which is basically what Solana people have been saying for years.

Ethereum is simply not meant for widespread use. Now, I do okay for myself financially, but I simply cannot afford to tack an extra 15-20 dollars at least in gas fees onto every mint or trade or action I conduct. It’s untenable. And if it’s untenable to me in the northeastern US, then it’s certainly untenable for the many millions of people from around the world who we all hope will find crypto during the next bull cycle. People are going to go where the money is, yes, but they will also go where they can actually do the things that they set out to do.

Another story: I was 19 and had never gambled in a casino. I sat down at a poker table somewhere in the Caribbean with 30 dollars I’d taken out of an ATM, I anted-up with everything I had, and then the first bet came to me. I checked, obviously. Except this poker table had a minimum bet per hand. Cashless, I couldn’t pay for the hand, so I was forced to fold, I lost all my money just like that, I got up, and I left the casino. This entire saga took place over about 90 seconds.

Consequently, it would suck to buy some ETH, set-up a Metamask wallet, find a piece of art or something that you like, go to purchase it, but find that you can’t afford the gas price. Or even worse, your transaction failed and took a chunk of your ETH with it. So sad, too bad.

That’s Ethereum.

Which is why so many artists have flocked to Tezos, more and more so every day since I’ve involved in crypto art. Tezos is cheap. It’s quick. It’s art-focused, though I think that’s an effect more than a cause of the chain’s success. But people don’t trust Tezos’ tech, and they don’t trust the Tezos foundation, and the bulk of both retail and corporate investment has taken place elsewhere, namely on Solana.

Now Solana’s art world is pretty small. There’s one big marketplace there, Exchange.art, where pretty much all 1/1 art is minted and sold. Basically Solana’s SuperRare. I haven’t used it too much, but they seem to treat artists well, which we can all obviously appreciate.

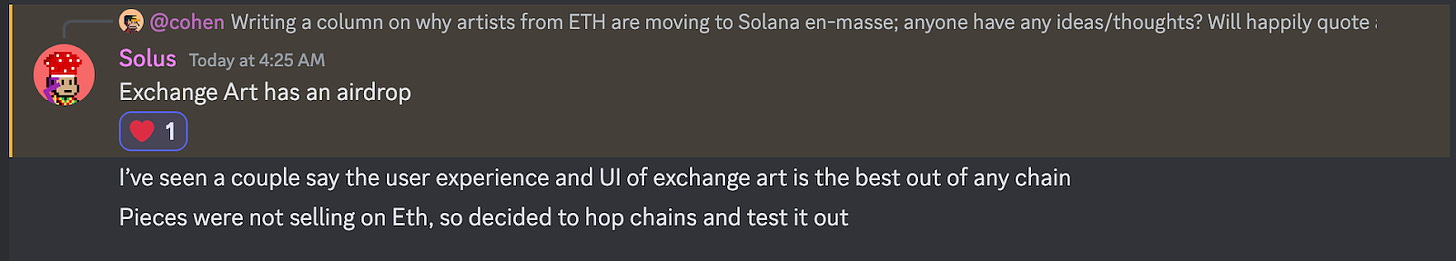

Solus, in one my discords, had this to say about Exchange.art:

But this is all foundational information. Solana folks have been saying this all this for years: Ethereum is too slow and too expensive, other chains have inferior infrastructure, our chain is so fast and so cheap and so sleek, everything should be happening here!

But why now?

I think there’s a short answer and a long answer. Short answer is money. In the same way that Ethereum’s DeFi summer in 2021 led to a massive amount of trading activity on the chain, Solana is having its “coming to the forefront” moment. Lots of airdrops, lots of memecoin activity, lots of Ethereum-rich people coming to speculate there, liquidity literally falling from the sky. If you’re an artist interested in selling your artwork, you veer to where the money is. If price drives narrative, then Solana’s recent price action and its mass of new liquidity are driving the narrative that it is is a superior technical chain to Ethereum. And that alone holds significant sway.

Not to mention that royalties are often enforced on-chain and across exchanges. That feels like an important note.

But the long answer is another story. It’s a story of rage and resentment. It’s a story of abandonment and hardship. It’s a story of a wolf in sheep’s clothing, centralization posturing itself as artistic freedom.

Ethereum is broken. We all know this. Culture on Ethereum has calcified. The ecosystem exalts a small subset of people and forgets the masses, sometimes happily so. The chain mechanics are financially exclusionary. Royalties are dead in the water despite years of community organization intended to safeguard them. There is painfully little in the way of fun and even less experimentation. Everyone has opinions, and they are not shy about sharing them:

Artists should mint.

Artists shouldn’t mint.

Artists should only mint this.

Artists should never mint that.

Don’t forget your collectors!

Don’t dilute your market!

You want the traditional art world to accept you right?

But the underlying problem is that very few people of influence seem interested in acknowledging Ethereum’s problems. Crypto art on Ethereum is not a free and open market. It is geographically-agnostic in theory alone. When you can name a dozen-or-more artists who have sworn off crypto art because of their experiences there, something is wrong with the ecosystem.

Solana doesn’t have much that Tezos or Polygon or Avalanche doesn’t have. There’s a veritable laundry list of chains with low transaction feeds, fairly wide adoption, and an art scene.

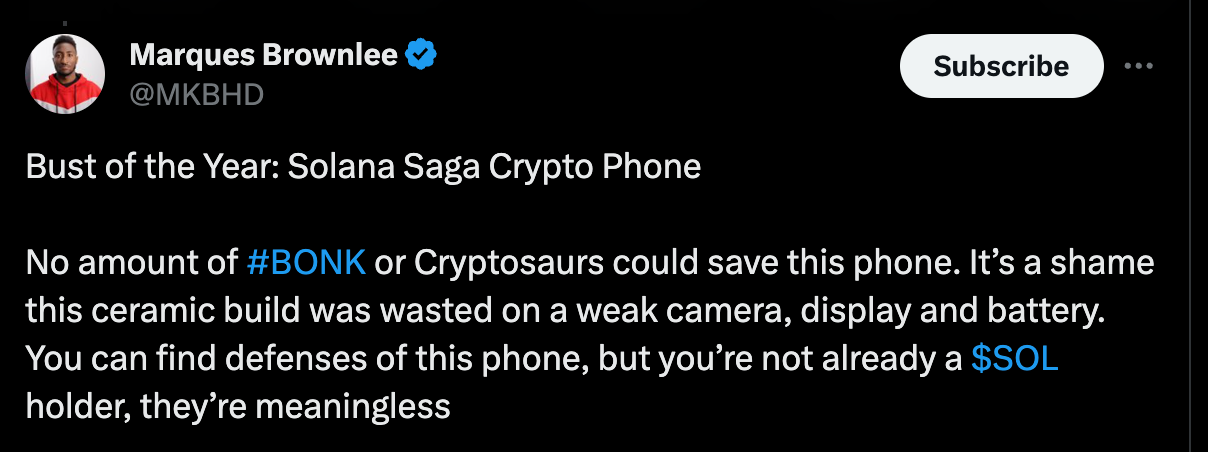

But Solana is a chain that fully embraces its own sheer ridiculousness. It loves its PFPs, and that’s just something ingrained into the chain’s culture. Solana founders Anatoly Yakovenko and Raj Gokal consistently rock PFPs from this-or-that random project. It’s a money-grubbing, shitcoin-pumping, ultra-centralized cesspool, but it knows what it is, and it isn’t apologetic. To me, spending most of my time on Ethereum, where influential people constantly deny deny deny the truth of the culture-killing we see before us, where we all cry out for decentralization even as more and more artists scurry to be recognized by Christie’s or Sotheby’s or other outdated and gatekept institutions, it’s actually kind of refreshing that the Solana ecosystem is unabashedly itself. It embraces its own bullshit. Case in point? Today one of the world’s foremost tech influencer’s named the Solana-native cell phone, Saga, the “Bust of the Year.” That immediately became a rallying cry for the Solana community. Solana, with its own “award-winning” phone.

I can see how that attitude would be attractive to a lot of artists who not only can’t find opportunities on Ethereum, they can’t find honesty about what’s happening there.

But having a ton of extra cash flowing around doesn’t hurt either.

I think Solana is honestly just fun and lighthearted in a way Ethereum isn’t right now. And it isn’t as often sketchy as Tezos can be. Solana has a respectable market-cap and some bonkers underlying tech. A lot of marks in its favor.

A revelation is coming, but I think Solana is only its momentary emissary. I think we soon see artists spreading out across a variety of chains. ZeroOne is bringing that same spirit of transparent fun and expression to Avalanche. Tezos has it on LOCK. Polygon could probably do a better job. Crypto art is simply spreading ourselves around away from being chain-locked on Ethereum. Today it’s Solana, and so Solana has the narrative. Next week, next month, a year from now?

Who knows? But I bet it will be something else, somewhere else, away from Ethereum. At least, that’s how I see it.

Thanks for a wonderful year everyone, and thanks for reading. I love these columns desperately, and I hope you do too. See you all in 2024.

- Your Friendly Neighborhood Digital Art Museum,

M○C△

TY for this. Always bullish on Solana - especially after the 'fall' of Sam the Fried Bankman - tho honestly i loathed many SOL pfps for a long time (and have yet to find a buyer for my OG Sollama. DM @voxeliving if interested). But I've matured now and am trying to curb my Eth-addiction (let's be frank). It's got to be an addiction when an app - forgot the name - was built more than a yr ago that painfully revealed how much $$ folks lost to 'gas' alone. I love many Eth artworks, but simply cannot afford to conduct practical business a crypto bro on that chain. And I couldn't ever see promoting it to 'normal' people. Those aren't just red flags, they're thick red walls. Anyway, shared this post and am looking for more. And yes, Exchange Art is ALL THAT.