Don’t miss an edition, hit this li’l ☝️☝️ subscribe button ☝️☝️ right up here. And catch up on every edition that passed you by.

In This Week’s Round-Up:

Nvidia made a cute robot (it’s so over for us)

A meditation on Bitcoin ATMs

What does collecting a “blue-chip” artwork get you?

Don’t Want to Read All This?

Okay, Let’s Get On With It

The Crypto Art Side

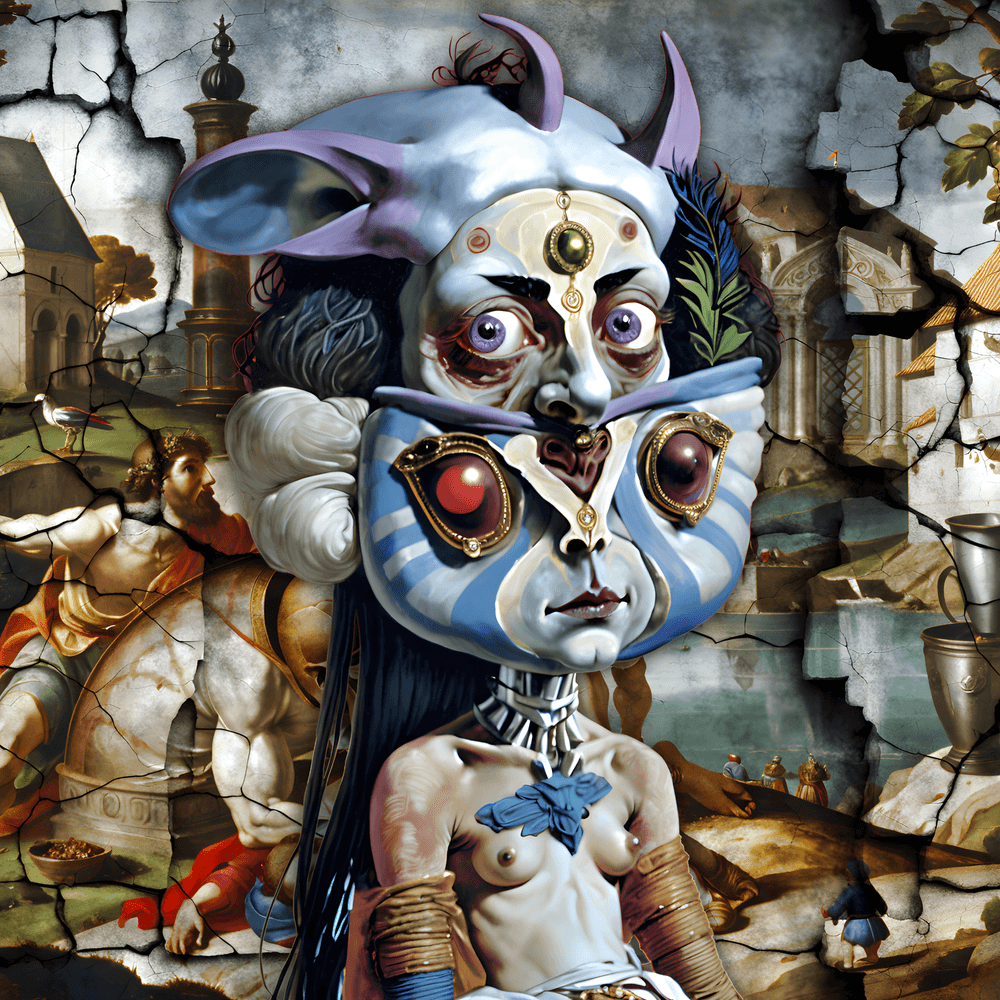

I’ve been thinking about so-called “blue chip” artworks this week, and perhaps that’s because I still have Sam Spratt’s Masquerade on my mind from my last newsletter. I remember looking through the piece’s website and coming to a mention of Kanbas, a collector (or collectors) who I had never heard of —and I don’t think I was alone in my ignorance— until they purchased Spratt’s 1/1 Masquerade, then still incomplete, for $3-million a few months ago. Now I know their name. You likely do too. They’ve since amassed ~4200 followers on Twitter, started using a Skull of Luci PFP, and will probably remain close (at least economically) to Spratt for a long, long time. They’ve conducted interviews, in just the last three months, with Beeple and with the Larva Labs creators, Matt and John. Likely, they will get first-look opportunities at lots of artwork to come, and maybe they will prove thoughtful stewards for the art they’ve collected (which “unites the innovation of 20th-century Latin American art with the digital art of today, creating a bridge between our heritage and our children's future” according to Kanbas’ website).

Talk about a whirlwind start to the year.

But understand that all of these things are rewards for their expenditure. Spoils. I’ve been at this crypto art thing a long time, and I don’t get interviews with Beeple. I don’t get invited to all the art fairs and shows and galleries, and even if I do, I’m an afterthought. But this is what you get when you purchase one of these “blue chip” artworks at some mind-numbing price. You get an in. You get an in to almost anything you like.

We talk a ton about the social value accrued with these purchases, but usually in the sense that one gains influence and followers. That’s secondary, in my opinion. What you really get is a seat at the table. Any table. What you really purchase —outside of the piece you (god-willing) love and have chosen to invest in— is top-of-mind consideration.

As header for this section, I chose to use XCOPY’s Right-click and Save As guy, because its $7-million sale to Cozomo de’ Medici back in 2021 elevated Medici to a new echelon of notability, even though he was already quite influential in our space, or at least quite well-known as a big spender. Medici —his name and persona both proof— is an ace marketer, and by getting himself a seat at this table, he’s turned himself quite literally (like it or not; though I like it. I think Medici is an overall positive figure in this movement) into nothing less than a crypto art icon. And because he’s an icon, his newsletter gets tens of thousands of subscribes and a sponsorship from Ledger. He gets sought after for collaborations with Rollbit and SuperRare and whomever else he would like to partner with. He gets an invitation to every dinner, every NFTNYC afterparty; at any conference, he would get to give a keynote address. Any door that Cozomo de’ Medici wants opened will do so on command. You can say he gets these things for his participation in the movement or the strength of his relationships, but we all know the truth —and it’s not a bad truth, either, it’s just the way of the world— which is that it’s because he spends. And our world crowds around the big spenders.

I’m writing this segment more as a response to my own overall confusion than any exterior events. I’m frequently confounded by how crypto art at-large can be so financially depressed, so argumentative and rambunctious and angsty, and yet massive sales for certain artists (Spratt, XCOPY, Botto, etc.) continue unperturbed. Auction houses continue to sell-out entire NFT-based auctions. Something historically hasn’t computed for me regarding that disconnect. There is money to spend, clearly, but it’s continuously being spent in more and more limited arenas. And I have long wondered why! I have wondered what these collectors are actually purchasing when they take $300,000 or $600,000 or $1.5mm or $3mm or $7mm and, instead of creating for themselves one of the greatest and most varied collection of crypto art in the world, they purchase a cryptopunk and another blue-chip artwork and sit back on their laurels as the adulation pours in.

But it makes some sense to me now.

They purchase notoriety. Their name because a capital-N Name. And in any worlds where social relationships are paramount —crypto art, as an offshoot of the art world, being one of them— a notorious name is the greatest asset one can have. It is a ticket to (apparent) fun, to fame, to further wealth, to influence and importance, to relationships with special people. For those with lots and lots of money and the right disposition, purchasing a blue-chip artwork is an investment without a downside, and you get a lot more than just an artwork to look at. It’s about the splash. It’s only about the splash. Make a splash, and it really does seem —upon further reflection— like the entire world (or at least our little corner of it) bends to incorporate you further into it.

The Tech Side

The first time I watched Spike Jonze’s AI-romcom, Her, I remember saying to a friend, self-assured and nonchalant, “Yeah, I’d fall in love with an AI too if she spoke like Scarlett Johansson,” which more or less sums up the plot of the movie, and also the plot of my love life. I don’t know how much Jonze intended for Johansson’s sweetened-condensed-milk-kinda voice to singlehandedly suspend our belief r.e. an AI/human relationship, but it’s hard not to come out of that movie believing that human beings can become quickly accustomed to just about any technological advancement assuming it’s packaged correctly.

And boy is this thing packaged correctly.

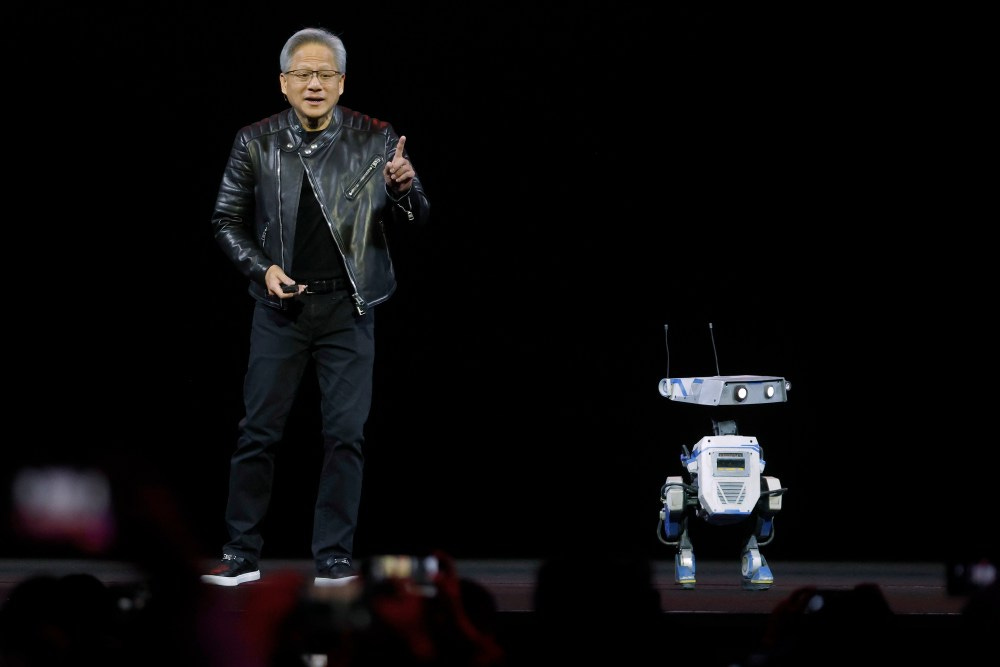

By this thing, I mean Isaac GR00T N1, the AI-powered robot running on Nvidia’s "Newton” model —“described as an open-source physics engine that lets robots learn how to handle complex tasks with greater precision”— which was unveiled in all its adorable, just-functional-enough glory by Nvidia CEO, Jensen Huang, at the GTC Developer’s conference this week. For clarity’s sake, in the picture above, GR00T N1 is on the right.

Huang is a brilliant public speaker, and a lot of his keynote address’ perceived success comes down to how naturally he comunicates with the GR00T N1 robot, how playfully he tolerated all then slowly-responsive dimwittedness as it hobbled around the stage, produced a series of incessant whirring noises, only sometimes on command, and eventually —emphasis on eventually— followed Huang’s directions to stand quietly beside him. If I had to judge GR00T N1’s performance, I’d give it a “Good enough.”

Todd Spangler, writing for Variety, paraphrases Nvidia when saying, “GR00T N1 can easily generalize across common tasks (such as grasping, moving objects with one or both arms, and transferring items from one arm to another) or perform multistep tasks that require long context and combinations of general skills.” In purpose, it seems to straddle a strange line between robotic pet and household assistant, probably failing at both. My Roomba, for comparison’s sake, never required feelings to do its job adequately.

Question being, will personality keep such robots from suffering my own Roomba’s fate, i.e. being shoved under my TV cabinet the past two years because it’s incapable of navigating my tiny Brooklyn apartment?

Disney is betting that they can, at least in public spaces, partnering with Nvidia to place droid-esque robots, like GR00T N1 (a Marvel-inspired name) around their theme parks. As curiosities and selfie magnets in vacation-lands, they’re no more impressive or invigorating than advanced animatronics. Disney claims “This collaboration will allow us to create a new generation of robotic characters that are more expressive and engaging than ever before — and connect with our guests in ways that only Disney can,” but how much can you connect with something that isn’t a part of your life? A fond memory and a relationship are different things entirely. The more pertinent applications will inevitably come in the home; robot acceptance will reach an apex only when they populate actual spaces, encountered unexpectedly and naturally.

Kim Kardashian’s recent photoshoot with a Tesla Robot demonstrates a more, shall we say, familiar method for robots naturalization into our lives, recalling a conclusion (incorrectly????) postured by The Sun in 2017 when their article claimed “Robot romance REVEALED: Women will be having more sex with ROBOTS than men by 2025.” But we put AI into robot for only one reason, and that’s to make them better at doing whatever they’re going to be doing. But what will they be doing? On its face, a cute robotic pet sounds fantastic, until you can’t keep it from whining and it always stands in improper spots. It’ll inevitably get turned off and put into a corner. Hell, I’d turn my own cat off every night if I could.

Of course, the developments of AI and robotics were always going to converge at some point. AI, however, is already outpacing robotics in personability —humans are more drawn to personality than form, as Her postured and as I think can be demonstrated by Sesame’s demo AIs, which I wrote about a few weeks ago— and utility. Even if an AI personality becomes beloved —for reasons of cuteness or conversation— if it’s trapped within a clunky, slow, stupid, blocky, clumsy robotic body, I fear that it will only ever get in the way. Besides, is AI better when given form? I’m not so sure.

Robots need AI, but AI doesn’t need robots, is what I’m saying. And Huang’s keynote is a very convincing new shell for robots, but brings almost nothing to AI frontiers. Does that matter? Would I even want my own AI robot —a personal Wall-E— to answer that question, or should its intelligence be capped at that of the humble feline?

The Finance Side

Honestly, I’ve never given much thought to the Bitcoin ATMs that seem to populate the New York City bodegas, these bizarre blue-and-orange kiosks with their prominently displayed Bitcoin logos, always barren, never in use, yet still advertised prominently on bodega doors: “Buy Bitcoin Here!”

Yeah, fat chance.

Seemingly installed more for Feng Shui than practicality, these Bitcoin ATMs are an omnipresent reminder of cryptocurrency’s still-fringe status; something about their blockiness and perennial state of abandonment makes them feel more like public fax machines or phone booths than gateways to cutting-edge technology. So I sure was surprised to find Mike Manzoni, for Fox9KMSP (out of Minneapolis, Minnesota), writing, “Should cities ban cryptocurrency kiosks to combat scams? Some are considering it,” referring to a series of phishing-style phone scams perpetrated using these mostly-unregistered ATMs. According to the article:

The scammers typically impersonate police officers or government officials, often convincing victims over the phone that they have committed a crime and need to pay money to avoid jail time. The scammers then stay on the phone and force the victims to lie to bank tellers, police officers and others. The scams conclude when the victims wire funds to the scammers via cryptocurrency kiosks, which are found at many convenience stores.

There’s something quaint and appropriate about local-news outlets being the only bastion for Bitcoin ATM information, given how widely-ignored the machines are outside of, unsurprisingly, shady criminal enterprises, which local news outlets looooooooove covering. I find it absolutely unsurprising that these things are only ever used to scam the crypto-illiterate, and I find it absolutely unsurprising that the local news would jump on an opportunity to marry crime with cryptocurrency, two thigns sure to incense their viewers.

Nobody with a semblance of crypto literacy, or a half-measure of online knowhow, would deposit real cash in a Bitcoin ATM, have the machine generate a wallet address via QR code, and then go on their merry way with any feeling of accomplishment. These things are reminders of a time before the deployment of online exchanges for Bitcoin —Coinbase, Robinhood, Bitcoin ETFs, to name a few— and so, naturally, their only users are weirdos or the perennially-scammed.

I suppose there is some idealist essence at the core of a Bitcoin ATM: perhaps it is the final resting place for true anonymity in crypto transactions, though you pay something like a 20% premium in exchange for generating wallet addresses without KYC requirements. Realistically, though, for 99.9% of crypto users there’s simply no reason to ever visit a Bitcoin ATM. Of course these things are used for criminal activity. I bet that if you were to track every user of a single Bitcoin ATM throughout a year, between drug pushers and money launderers the scam victims, you’d account for nearly 100% of users (maybe throw a few drunk college kids in for fun).

So why have these things at all?

I can come up with no practical reason, though if you want to argue that they fulfill Bitcoin’s promise of anonymous transactions, I guess, whatever, you can make that argument, though I’d counter with, “How are you going to transfer that Bitcoin back into actual money, then, smart guy?” which seems to be a problem most overlook in any conversations on the subject.

Forgo practical reasoning, however, and join me in thinking about the aesthetics of the thing. A readymade kind of sculpture which mimics the design and nomenclature of the Automatic Teller Machine for no other reason than mainstream identifiability. A chunky callback to the brutalist computers of yesteryear, the great greyish-beige behemoths that would sag all but the sturdiest desks under their weight. The inherent irony in these ancient machines deployed to handle among the most technologically-complex financial products the world has ever known. The silly joy of stumbling upon one of these things next to some Bodega cat’s litterbox, taking up space beside the hotdog rollers in a midwestern 7/11, the forced acknowledgment of our whole enterprise’s ridiculousness. Existing in past and present and future all simultaneously, the Bitcoin ATM is a simulacrum of crypto at-large: stodgy and unwieldy and wildly powerful and completely impractical and unconcerned with accessibility and absolutely unwilling to change its ways.

Get these things off the streets and into art museums, I’d say. Unplug them for good and cover them in graffiti. Who in their right mind would ever use one, I wonder. But goodness gracious, who in their right mind wouldn’t look upon one with glee?

DeCC0 of the Week

Art in the Wild

Dev Corner

This week our Devs are engaged in:

• continous work on the museum core stack

• filters update for decc0s.info (goes live nxt week)

• ai fueled research on n8n pipelines to scale feeding the museum library (via r2r)

Quote of the Week

“You exist only in what you do.”

-Federico Fellini

Do you have some news that simply must be shared? Send us a DM