Don’t miss an edition, hit this li’l ☝️☝️ subscribe button ☝️☝️ right up here. And catch up on every edition that passed you by.

In This Week’s Round-Up:

Trickle Down Art-onomics: Fallacy or Fact?

The EU Bans AI Agents for Internal Meetings; A sign of things to come?

An Impassioned Defense of Content Coins (by others, lol; they’re just today’s load of fresh slop)

Okay, Let’s Get On With It

The Crypto Art Side

I really like Toni Marinara, we all do at MOCA, as is evident in the Honorary Art DeCC0 we made for him in January, all of which is to say that my ensuing points are about the claim and not the man, because I think the claim, while noble, is unfortunately bunk. That said, I’d forgive anyone for sharing Marinara’s above point of view here, which is that emerging artists (a tidy shorthand for artists who have never seen consistent financial success from their work) will naturally benefit should a thriving market continue to grow around large artists, so-called '“star systems of influence” (as DADA wrote about back in 2020): XCOPY, Cherniak, Spratt, Hobbes, Anadol, you understand who I’m talking about.

Toni is a good dude, and a treasured member of the trenches, but I’m wary of this point-of-view, even after he contextualized it later when saying:

“Perhaps my [original post] wasn't well articulated - but for NFTs to do well, & I do believe we have seen this in the past, the environment needs to be set for a flourishing ecosystem…This time, I think it's actually vital for [Big PFPs, niche long-form collections, and established artists’ 1/1s] to do well in order for ETH in general to flourish, providing necessary liquidity for people to feel comfortable to support more emerging artists.”

I’ve heard many arguments —and made a few myself— about the importance of a thriving top-end of the market, which would theoretically inspire collector confidence in risk-taking on lesser-known artists. But the longer this ecosystem develops, the less collectors (or investors) seem interested in taking risks at all. Over time, the ossification of a crypto art hierarchy has only progressed, with the help of Vincent van Dough’s Art of This Millenium agency, Makersplace and SuperRare’s pivots towards white-glove service, and the reduction in crypto art collectors in general. I did link a Dune.xyz chart, but did I need to? Is anyone really under the impression that crypto art is getting better for emerging artists, or that there are more risk-taking collectors than before? I imagine most of us have been disavowed of such beliefs.

And yet, within these years of further denigration for emerging artists, the big names have not slowed down their accrual of money and influence. Sam Spratt’s Masquerade, the consistent barrage of XCOPY secondary sales, Cherniak’s Goose sale from 2023, massive Botto sell-out drops, including the recent Bharat Kyrmo purchase of Prismatic Safari for 55 ETH. If anything, large sales are the only that have continued unabated through the fluctuations in crypto and crypto art markets, with the exception perhaps of wicked-low priced artwork on Tezos or Zeroone —which do not require much financial risk to acquire— and a few collections/pierces here or there by pioneering artists with unique niches like Linda Dounia or Sarah Meyohas or Osinachi.

(I do want to say, there are probably 100-150 artists I can name currently making a living, or part of it, off their ETH-based crypto art [the only kind I’m qualified to talk about], and I’m happy to hear the argument that this alone proves Marinara’s point, considering what is customary in past art movements. So if you want to make that argument, I’m here for it).

And yet, if big sales did trickle down to emerging artists, don’t you think we would have seen evidence of it by now?

I believe that Marinara’s narrative was truer in early crypto art, but I think the market has petrified since then. Certainly, right after the $69mm Beeple sale in 2021, crypto art collectors old and new, witnessing the creation of a true market, invested heavily in any and all artists, beyond single mediums or styles. The hierarchy of value was then still-developing, so collectors could justify making big bets on any artist, whether pointing to an artist’s historical track record or their aesthetic originality, any reason persuasive enough to justify why this or that artist should be valued much more highly than they were. That is what inspired the rise of emerging artists in a previous era: the market was then unsettled.

But what has happened since then? A selection artists emerged from protozoic crypto art to find themselves encased in that upper-echelon of valuation, but what about their peers, whom present collectors overlooked or did not escalate so far upwards? Invest in an “emerging” or lesser-valued crypto artist in 2021 or 2022, they may have had a few dozen market rivals. 1 in 50, that’s a fair bet to make. Today, hunderds upon hundreds of artists vie for less and less attention, and there’s seemingly no rhyme or reason as to who gets elevated higher other than knowing the right people.

Marinara’s suggestion, however, is that the existence of a high market proves to collectors that they can make such bets on emerging artists, but who would you bet-on if you had $100k to bet? Would you collect work from relatively small time artist with an interesting style, or someone with an already growing portfolio? Would you deploy your money widely into unknown Tezos artists, or would you choose the girl with preexisting connections to big-name collectors? The answers are verifiably, for many, obvious.

Which is why I’m wary of the “trickle-down” theory. It is not in anyone’s interests —not established artists, not collectors, not the market— to spread wealth around to undiscovered or still financially-unsuccessful artists, not unless they have a moral imperative to do so. But we can’t trust in moral imperatives in crypto art, not after we’ve had royalties stricken so painfully from our day-to-day.

I’m not hopeless about the case for emerging artists, but I don’t think that the emerging ecosystem is helped by the dynamics of the upper-echelon, where artists and market-makers all share the same vested interest: sucking all available liquidity into itself to justify 2x/3x/10x/50x price increases atop an already five-or-six figure valuation. 2x-ing a $100,000 investment is an easier ask than 100xing a $1000 one. And unfortunately, few collect big-name artists because they “love the art”; don’t get suckered-in to that assertion. These are investments, and they need to be discussed and understood as such.

I guess I just see these two places as philosophically distinct. Collectors support emerging artists because they love art and artistic culture; they spend a salary on art only when the investment thesis is clear. I don’t see much overlap between the two worlds.

The Tech Side

As per Pieter Haeck at Politico, the EU this week —that is, the physical body of the European Union, in Brussels— announced they are prohibiting, “virtual assistants powered by artificial intelligence from participating in its meetings. It imposed the rule for the first time on a call with representatives from a network of digital policy support offices across Europe earlier this month.” In the futue, Haeck notes, “the AI models that power the agents will have to abide by the EU's binding AI Act,” which assumedly establishes the proper channels towards agentic usage, but for now, agents are caput in the highest governmental halls.

Haeck quotes the EU itself when he classifies AI agents as “‘software applications designed to perceive and interact with the virtual environment’…Agents can ‘operate autonomously,’ but their work is set by ‘specific predefined rules,’” and I direct your attention to the final clause therein: “specific predefined rules.”

Though the article that the EU “[declined] to give more details on the policy and reasons why it took the decision,” my gut says it’s the implication of these “specific predefined rules” which is the problem here, and which will continue to be a problem for AI agents in any realm in which sensitive information is being shared. We don’t blindly trust humans in classified spaces, which is why we sign contracts and threaten legal action. AI agents, meanwhile, act according to procedures buried deep in their transformers. Without holistic legislation determining who is legally responsible for an agent’s activity, of course institutions concerned about data safety will keep automated entities from inclusion.

Moreover, there are consequences to the attitude of the AI industry, wherein progress is pursued at all costs, while legal or ethical responsibility is something to be denied, denied, denied, or otherwise justifed as necessary in the pursuit of growth. The same way OpenAI plows ahead with copyright infringement when its models generate Studio Ghibli-styled photographs, all indications are that they would sidestep liability if their agents treated sensitive data loosely, or were convinced into opening back doors, or, worst case, by din of making the lives of government officials easier (even just when it comes to taking notes in a meeting), start to subtly impact policy itself. If I give a 15-minute speech about the dangers of AI, and an outside agent compresses my words into four or five bullet points, the convincing details of my argument might go by the wayside, and of course, the makers of agents themselves have a vested interest in certain outcomes, and can find ways to influence things subtly.

Even in our little art world, the question of agentic intent is extremely important. Before MOCA releases Art DeCC0 Agents, we will need to ensure a way to keep these agents from being overly drawn to higher-notoriety or higher-selling art for purposes of collection or discussion. Others may not have the same values. Will an agentic-centric crypto art only result in further consolidation? We’re dealing with active entities that will have directives and preferences, but how do we know what those preferences and directives are?

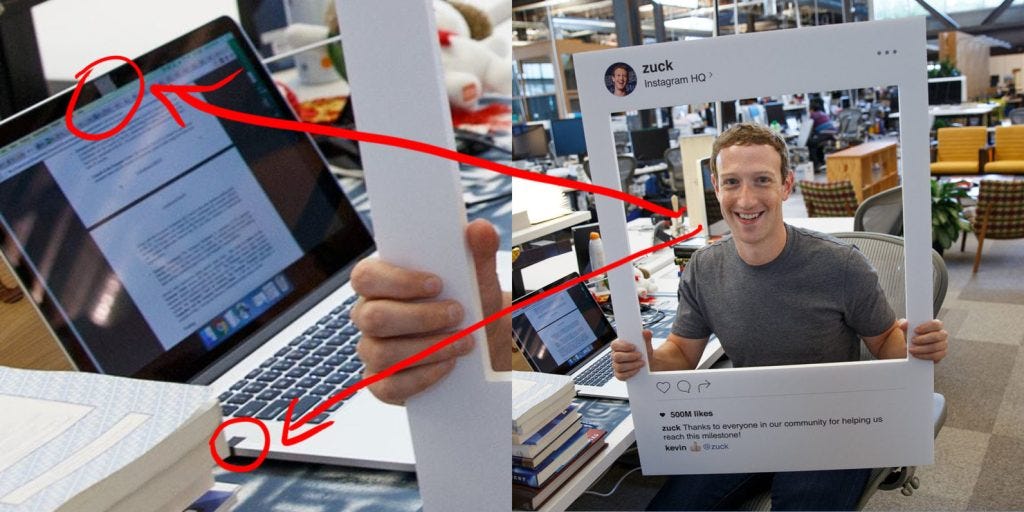

For some reason I am reminded of that time Mark Zuckerberg, speaking often about how safe data on Facebook is, unaware that we could see his laptop behind him, where his camera and microphone were covered with duct tape.

The Finance Side

*Edit 12:31pm EST Monday 4/21: wanted to include thoughts on the matter by ZachXBT, specifically as it relates to Zora’s involvement herein.*

I can’t say I’m surprised by how much vitriol Jesse Pollak, creator of Base, has been receiving this week for his pretty forcible suggestion that all content on the internet can and should be tokenized into what he calls “content coins.” It’s rocketed Pollak —and also Jacob Horne, founder of Zora (he’s also the AI artist, Zaza) where such content is currently being coined— into the center of public discussion, this belief that:

“If a video on tiktok has millions of views, it has value. why should a single platform control that value? why shouldn't that value be explicit? why shouldn't the creator benefit from that value?”

The discussion emerged earlier this week from some confluence of Pollack’s and Horne’s collective ideas, which led to a massive spike of activity on Zora. Horne twisted the argumentative knife saying:

I have some thoughts on content coins, but I thought it would be helpful if I collected below some of the main back-and-forth points in what has proven to be a lengthy dialogue about whether more tokenization is necessary/good/useful:

Here’s Pollack discussing “coined content” on the Bankless podcast, specifically as it relates to how content coins are different from memecoins. He also posted a graph that lays out what he sees as the key differences between the two.

Here’s so-called “builder on base,” Poet, defending the content coin idea, a point that MadladShad emphasized.

Here’s Pollack mentioning a specific positive instance of “content coining,” and here’s his retrospective on what, again, turned into a fairly vitriolic argument (whch may or may not have included charges of uncouth behavior in what was being minted and collected on Base, I honestly don’t know, but he apologizes for something).

Here’s influencer ArtChick talking about her experience buying content coins on Zora recently.

My favorite addendum to the conversation, however, is CEO of Helius, Mert’s tongue-in-cheek conjecture about the future of content coins:

Much of the criticism revolves around the mechanisms by which the main content-coin-creating engine, Zora, uses their minting in order to capture transaction fees. Ezra Shibboleth helpfully compared Zora, Rodeo, and Shape, which all do basically the same thing, and how they each handle platform fees. I don’t know exactly how Zora and Base’s interests are aligned in this matter, especially given that, as I understand it, they are competing products, but we do seem to have approached a point where the central question of crypto is finally being asked:

Should we tokenize literally everything?

The defense of content coinage simply says, yes, claiming that there’s no reason for us to accept visual NFTs, music NFTs, and memecoins as normal but not content coins. In a vacuum, I don’t really see how you argue with that: what makes social media content inherently less valuable or less worthy of being minted than a JPG, mp3, or idea? You can argue, I suppose, that little of what’s been historically minted on-chain should have been minted on-chain, but as soon as you start making that argument, you broach a question of “Who gets to decide?” which calls to mind MOCA’s own mission statement, where we ask, “What is art?” and “Who decides?” Nobody should have that power.

As per the cultural value of content coins, I mean they obviously have none, but that’s never stopped the crypto public from investing their time and attention into things! We’ve spent months chasing memecoins for literally whatever was trending on Tiktok that day, and this really isn’t any different. It will be used as a speculative vehicle for a while, probably turn some otherwise unknown individuals into influencer types (who will then become posterchilds for “how good this is for creators”), and fizzle out as quickly as it came, and we’ll all look back and say, “Wow that was weird,” and move on.

I suppose I’m just surprised that we’re seeing so much disbelief at what is clearly a cash-grab wrapped within a fairly-legitimate argument. We’ve been down this road before, we’ll be down it again. None of this content has any value, it just has attention (“bUt AtTeNtIoN iS vAlUe”), and it’s going to attempt to monetize its own attention. Zora and Base specifically, two companies that function exclusively off of attention (and I don’t mean that as an insult, but L2s make their money through transaction fees) will push this and push this and push this until they’ve squeezed everything they can from traders and creators, but that’s their entire business model. None of this is new, despite how it’s been packaged, and while we can lament all we want, I thought we’d long-since exhausted our tears over the subject of hyperspeculation.

It could be worse, by the way. This could all be happening on Blast. Remember them? God, we’re so toasted.

DeCC0 of the Week

Art in the Wild

Dev Corner

This week, we’re on the doorstep of MOCA V2 Website release and the launch of The Moral Collection, by Matt Kane. Here’s what devs have been up to:

- forked R2R repo and modified+prepared our dockerized MOCA Library stack to be deployed with less friction via Coolify onto our staging system. goal is to simplify the deployment of the MOCA Library for anyone else who deploys a museum

- Migrated the prototype r2r instance to the coolify staging system

- Started to integrate the MOCA Library into the MOCA Backend Collections views via R2R SDK on our staging system

Quote of the Week

“This is the most joyful day that ever I saw in my pilgrimage on earth.”

-Donald Cargill

Do you have some news that simply must be shared? Send us a DM