Don’t miss an edition, hit this li’l ☝️☝️ subscribe button ☝️☝️ right up here. And catch up on every edition that passed you by.

In This Week’s Round-Up:

SuperRare Continues to Find Itself (intentionally and unintentionally) in the Limelight; plus, a primer on CryptoCubes that’s well worth your attention

When $3b Valuations are Being Handed out like Candy, the AI Bubble Might be Close to Bursting; also, Meta’s new powerhouse open-source models have arrived

A Reckoning

Okay, Let’s Get On With It

The Crypto Art Side

Crypto art drama always feels fairly meaningless as it’s happening, and so I won’t rehash this week’s clash between SuperRare and Jack Kaido, which spent Friday going back and forth and back and forth again. I think the far more pertinent conclusion drawn from this disagreement is that, in what is honestly a pretty rare circumstance for a crypto art platform in 2025, SuperRare is front-and-centered in the zeitgeist, which for matters of their survival and notoriety and brand value is obviously quite important. And a similar thing happened earlier this week for reasons of their own intentional invention! On Wednesday, SuperRare announced that it would be bringing in curator Roger Dickerman, founder of 24 Hours of Art, to “grow the onchain art market, expand reporting and analytics, build best-in-class Private Sales, and deliver the definitive Annual Report,” (whatever that means) in what seems an extension of their previously announced redirection towards white-glove service and high-profile sales.

Again, the tenor of their collaboration, its effects, whether it’s a good idea or not, all of that is besides my point today. I will personally reserve judgment until I see results, especially given that my own staunchly-stated personal prerogative is SuperRare’s continued survival and growth. But on that note: SuperRare is in the news! A lot! That’s unexpected, isn’t it? For months, marketplaces and platforms have struggled to get anyone to care about them. And yet, here we are. What can we learn about crypto art from SuperRare worming its way, twice in just the last few days, for reasons in their control and outside of it, into the front-page of our cultural consciousness?

This proves, at least, that there’s still some cultural capital available to crypto art institutions; it is still apparently within their power to impact artists and the artistic ecosystem, they are seen as tastemakers, their decisions —good or bad— have impact. Take that for granted if you like, but the past two years have basically been one elongated wave of such institutions being treated —either financially or socially, the mourning over their closures far louder than attempts to support them (for reasons I often understand)— as superfluous. If SuperRare is able to make waves of discussion by enlisting Roger Dickerman to their side, that proves A) that people are inclined to discuss a platform’s merits instead of ignoring their attempts at newness outright, and B) big players in crypto art like Dickerman see collaboration with such platforms as useful. I suppose Sam Spratt continually enlisting NiftyGateway for his Luci-related drop mechanics is similar, now that I’m thinking about it. When else in the last few years has NiftyGateway slid into the cultural crosshairs?

We can lament it further or we can accept it for the moment as standard: crypto art constantly centralizes its power and influence in a few hands. Sure, it feels somewhat icky that SuperRare is leveraging this power consolidation for its own sake, but I don’t fault them for it. Especially because people like me will write about them in the aftermath of such decisions. And yet, I think about Async.Art’s “Forever Supper” project, the last large release they attempted before closure, with artists like Hackatao and Matt Kane and Gremplin were launch or near-launch partners, and how incapable of wide attention-capturing this proved. I think about whether Makersplace would still exist if they had affixed themselves to some influential collector or curator. I think about the nonstandard path Sovrn —co-founded/supported by Pindar van Arman and also with much of its continued relevance stemming from the outright success of Rutherford Chang’s Cents project— and see no clear path any other platform could follow, so perhaps there’s many case-by-case mechanisms towards relevancy, none of them a panacea for everyone.

That both of SuperRare’s avenues to relevancy include high-profile individuals in the movement —Kaido on the artistic side and Dickerman on the curatorial— is also interesting. Who has the power in crypto art at the moment? When we look at a Roger Dickerman x SuperRare collaboration, who benefits the most socially? Is this better for Dickerman’s image or SuperRare’s? I wonder who approached who and what each’s real goals are. Who wants to use the other to get behind closed doors and into overstuffed pockets? What pockets and room were previously unavailable to them?

I want to return to this topic in a few months, after we know a bit more about how SuperRare’s new direction works in practice, whether they continue to seek what I suppose we can call “high-value” partnerships, whether they continue to serve a smaller and smaller clientele, whether they can sustain their relevancy. It’s hard to draw any further conclusions at the moment, but their sudden reappearance in daily conversation is rare, and if it’s rare it’s noteworthy, and if it’s noteworthy, it’s worth our closer attention, don’t you think?

The Tech Side

Comparing today’s AI market to the DotCom Boom of the late 90’s is nothing new, though I’ve been generally reticent to indulge such a fear-mongering juxtaposition. BUT —and that’s a big BUT (the first of a few herein)— if there WERE an AI bubble forming beneath us, there would be warning signs. Like perhaps the massive drop across AI stocks —most notably Nvidia, though also crypto-based AI coins like $ai16z and VeniceAI— after Chinese AI models like Deepseek and Manus were unveiled and released to the public, proving indisputably that western hegemony is not a given, and that perhaps the way we have been constructing our AI models was misguided from the start. If there were to be a bubble here, the sudden and powerful wavering of the entire market from a single financial threat might be proof.

A second sign, to me, is something like this week’s news that Runway, an alleged text-to-video AI company, raised $308-million dollars in a Series-D Funding Round, for a total valuation to the tune of around $3-billion. Quoting directly from Kyle Wiggers of Techcrunch:

“Runway offers a suite of AI media tools, including video- and image-generating models. It faces stiff competition in the video generation space, including from OpenAI and Google. But the company has fought to differentiate itself, inking a deal with a major Hollywood studio and earmarking millions of dollars to fund films using AI-produced footage.”

Our second noteworthy “BUT” of the day is the one doing all that heavy-lifting in this announcement of a multi-billion dollar valuation. It’s fair to wonder why so much money would be poured into a company that, as OpenAI’s Sora is continuously optimized, will be forced to contend with one of the industry’s premier powerhouses, and that’s without mentioning how hysterically hostile the general public remains to any use of AI in cinema. There was, recently, a massive controversy around the use of AI to finetune Adrian Brody’s Oscar-winning Hungarian accents in the Brady Corbet film, The Brutalist. Just a smidgen of gen-AI in post-production, and people lose their minds. I also remember a smaller uproar regarding a few seconds-long (literally) inserts in the 2023 film, Late Night with the Devil, made to look like mid-commercial announcements during a 1970’s talk show, once it became known that they were AI-generated.

For those two reasons alone —not to mention that Meta’s Llama4 LLM model was released hours before I wrote this, and it’s open-source, so who knows what internet warriors build with it; but more on that in a moment— I find it hard to believe that investment into a company like Runway is anything but massively risky. And yet, according to Wiggers, investment was led by heavy hitter like “Fidelity Management & Research Company, Baillie Gifford, Nvidia, SoftBank, and others.”

Apparently, “The fresh capital will be put toward AI research and hiring, Runway said in a press release, as well to expand its Runway Studios film and animation production arm,” though unlike OpenAI or Google, who can both afford, with their other massive revenue-generating arms, to wait-out our collective societal distaste for AI art in the mainstream, Runway is a company built entirely on the hopes that we get over this distaste quickly. But $3-billion is a big ol’ bet to make on something that seems entirely out of anyone’s control, and who knows, may get worse before it gets better.

I can’t claim expertise on the entire realm of investment in AI companies, but this feels noteworthy. At $3-billion, Runway’s valuation exceeds —okay, at this point, no bullshit, I went to ChatGPT, and I asked it to list some well-known companies with valuations between $2.5 and $3-billion; I was given a laundry-list, somewhat surprisingly, of other AI companies with similar valuations, including Vultr (a cloud AI startup), TogetherAI (with an even more ambiguous description), AlphaSense (an AI market intelligence platform), and ReliaQuest (an AI cybersecurity firm). All have valuations at or around $3-billion. And that’s just a few! I’ve never even heard these names before, though perhaps I shouldn’t have, given my complete ignorance of the business world.

But is every AI-based company with a snazzy-sounding name and an innovative pitch worth multi-billions? Open question. If so, great! That means these are reasonable bets on a market that’s only going to keep growing exponentially.

But the tech industry as I understand it is notoriously hostile to newcomers, and the behemoths one is up against in the AI market are among the world’s largest, furthest-reaching, most powerful. Orphans facing off against the FAANG Dynasty. Moreover, AI tools are going to continue being used to create other AI tools; there’s a reason why many see computer engineering as among the most AI-threatened industries. As I said in the last section, my goal here isn’t to draw conclusions, especially in realms I know little about, it’s to draw attention to oddities. And doesn’t this all seem…odd to you? I’m sure there are dozens, maybe hundreds more of these flaccid-seeming AI-based companies drawing valuations in the multi-billion-dollars. What do you think? Are enough of those going to pan-out as gloriously as their investors hope? Or is this too-rampant speculation on a nascent industry that seems well on the way to being consumed entirely by established actors. Just something to chew on.

In other news, Meta and Mark Zuckerberg revealed their Llama4 models yesterday, which could be a game-changer in terms of sheer LLM output (if their boasts are confirmed), but most importantly signify the release of a truly top-tier model into the open-source ecosystem. Open-source is the way out of an over-centralized AI ecosystem, that I truly do believe. I don’t love everything Zuckerberg has created or done, but he and his company’s consistent insistence on open-sourcing their models is really heartening. We’ll see what open-source devs, good and bad, do with access to an alleged Howitzer.

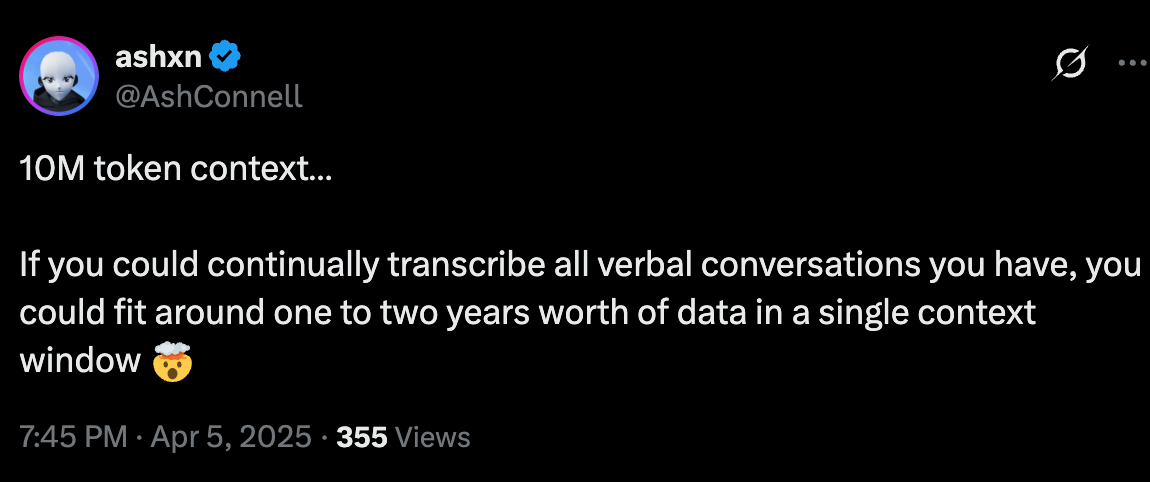

But about those aforementioned boasts, Ashxn, founder of Hyperfy.io, put them into the most awe-inspiring context:

The Finance Side

American markets open at 9:30am EST tomorrow. Get your houses in order. I’m seeing comparisons (and comparisons and comparisons) to Black Monday. Let us pray.

DeCC0 of the Week

Art in the Wild

Dev Corner

Finalizing our first big release of the year. Going to be big. Will have more news after launch. Might be next week, might be the week after, but we’re on the verge of something. Stay tuned.

Quote of the Week

“The only sure weapon against bad ideas is better ideas.”

-Alfred Whitney Griswold

Do you have some news that simply must be shared? Send us a DM